ct sales tax exemptions

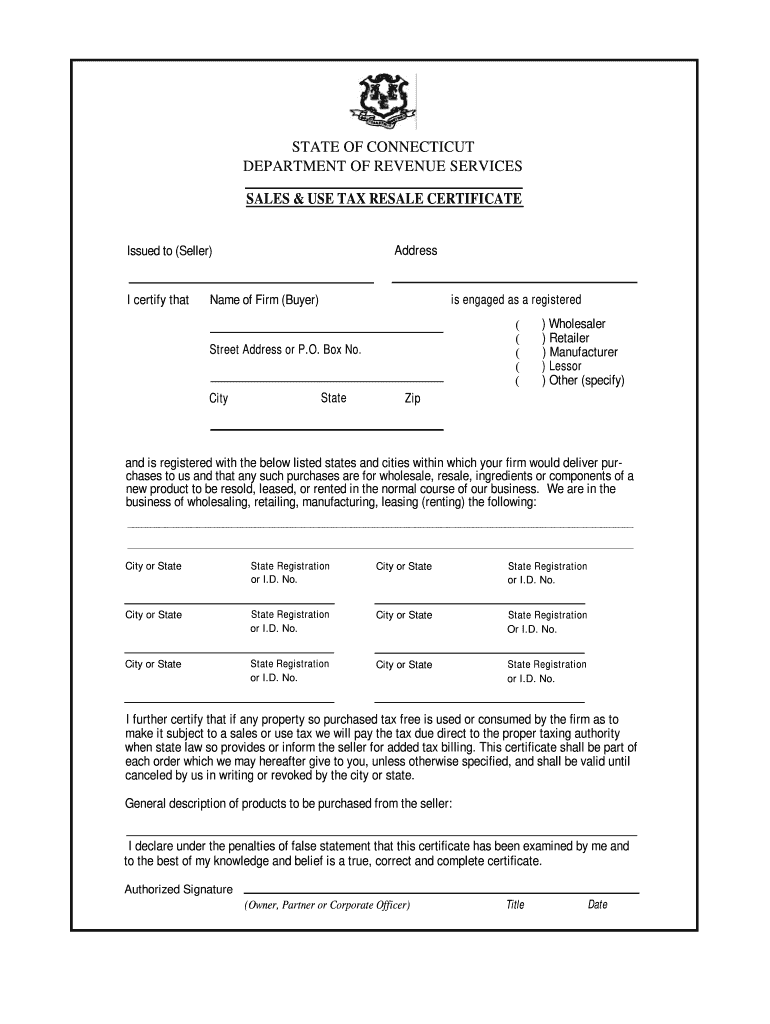

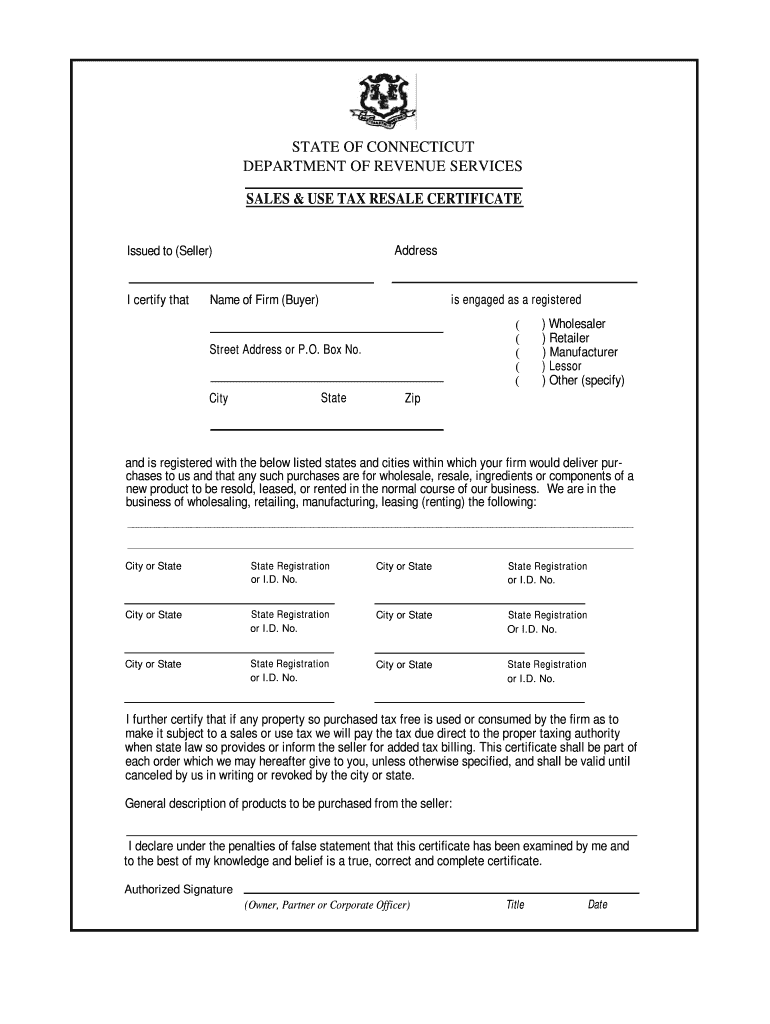

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. 44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut.

Sales Tax On Business Consulting Services

Applicable to certain services prior to June 30 1987.

. Connecticuts Extreme Hot Weather Protocol will be activated from 8AM on Tuesday July 19 through 8PM on Sunday July 24 2022. Military member stationed in. Renewal of Your Sales Tax Permit.

Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations. Groceries prescription drugs and non-prescription drugs are exempt from the Connecticut sales tax. Manufacturers and industrial processors with facilities located in Connecticut may be eligible for a utility tax exemption.

Exemptions from Sales and Use Taxes. What is Exempt From Sales Tax In Connecticut. FilmTVDigital Media Tax Exemptions Find out more about the available tax exemptions on.

Connecticut has a statewide sales tax rate of 635 which has been in place since 1947. Exact tax amount may vary for different items. Ad CT ExemptNon-Exempt Status More Fillable Forms Register and Subscribe Now.

The state imposes sales and use taxes on retail sales of tangible personal property and services. Training and funding provided by state and local agencies educational institutions private companies others. This page describes the taxability of services in Connecticut including janitorial services and transportation services.

To learn more see a full list of taxable and tax-exempt items in Connecticut. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635. Filing a Timely Sales and Use Tax Return.

Simplify Connecticut sales tax compliance. 2021 Connecticut Sales Tax Free Week. Over 300 stakeholders are membersadvisors to the Council including business leaders educators philanthropic and community-based organizations.

Counties and cities are not allowed to collect. For example on a sale of 10 the tax is 10 times 0635 635. Go Paperless Fill Sign Documents Electronically.

Are drop shipments subject to sales tax in Connecticut. Keep 100 of the sales tax they collect on meal sales during one of the following weeks. Connecticuts Extreme Hot Weather Protocol will be activated from 8AM on Tuesday July 19 through 8PM on Sunday July 24 2022.

Calculating Connecticuts sales and use tax rates. Beginning on the July 1st 2011 the state of Connecticut levies a 635 state sales tax on the retail sale lease or rental of most goods. Responding to urgent workforce requirements.

Exemption from sales tax for items purchased with federal food stamp coupons. Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. There are exceptions to the 635 sales and use tax rate for certain goods and services.

2022 Connecticut state sales tax. Sales and Use Tax Exemptions for Beer Manufacturers Under a new law beginning July 1 2023 specified manufacturing-related sales and use tax. CT Sales Use Taxes.

Factors determining effective date thereof. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. 45 on motor vehicles purchased by an active duty US.

File Your Business Tax Return using TSC. Scaling to meet industry-wide needs. Connecticut offers an exemption from state sales tax on the purchase of electricity natural gas and water used in qualifying production activities.

Amending a Sales and Use Tax Return How to Get a Refund or Credit for Sales or Use Tax You Paid in Error IP 200723. While Connecticuts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. It imposes a 635 tax with some exceptions on the retail sales of tangible personal property purchased 1 in Connecticut ie sales tax or 2 outside Connecticut for use here ie use tax.

No local jurisdictions apply an additional sales tax therefore the state rate is fixed at 635. Simply multiply each dollar of a sale by 635 percent. April 2022 Connecticut Sales and Use TaxFree Week.

Purchases by Nonprofit Organizations Rules for Exemption from Sales Tax Direct Pay Permit. State tax audits bring transactional errors to the attention of the boss by the state issuing tax assessments. Cooling centers are open statewide.

Ad Fill out a simple online application now and receive yours in under 5 days. 2022 Connecticut Sales Tax Changes. Amending a Sales and Use Tax Return.

Go Paperless Fill Sign Documents Electronically. Use tax is due on items purchased outside of the state and. Ad CT ExemptNon-Exempt Status More Fillable Forms Register and Subscribe Now.

Sales and use tax exemption. Services Subject to Sales and Use Taxes. Municipal governments in Connecticut are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a total of 635 when combined with the state sales tax.

Sales Tax Relief for Sellers of Meals. Cooling centers are open statewide. UConns Sales Tax Exemption Letter from the CT Department of Revenue Services.

Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which is shipped to the end-user by a third party supplier hired by the initial vendor. The total of the sale and the tax is 1064. Avalara AvaTax plugs into popular business systems to make sales tax easier to manage.

How to use sales tax exemption certificates in Connecticut. May 15-21 2022 PA 21-2 JSS 436 effective July 1 2021. The Connecticut Exempt and Taxable sales tax book for manufacturers educates on the states sales tax exemptions exclusions from tax and taxable purchases of the business starting with advertising and ending with warranty repairs.

An organization that was issued a federal Determination Letter of exemption under Section 50lc3 or 13 of the Internal Revenue Code is a qualifying organization for the purposes of the exemption from sales and use taxes. Sales of Food and Beverages at Schools and Care Facilities Exempt from CT sales tax. In Connecticut drop shipments are generally exempt from sales taxes.

We will update this page monthly with any rate changes that may occur in the future. Filing and Amending Sales Tax Returns. Because Connecticut has just one sales tax and no discretionary taxes it is very easy to calculate your tax liability.

Exemption from sales tax for services rendered between parent companies and wholly-owned subsidiaries. Purchases of Meals or Lodging by Tax Exempt Entities. This tax exemption is authorized by Conn.

7 on certain luxury motor vehicles boats jewelry clothing and footwear. There have been no changes to the Connecticut sales tax of 635 or local sales taxes within the state over the last year. UConns Tax Collection Matrix for CT Sales Use Taxes Admission Taxes and.

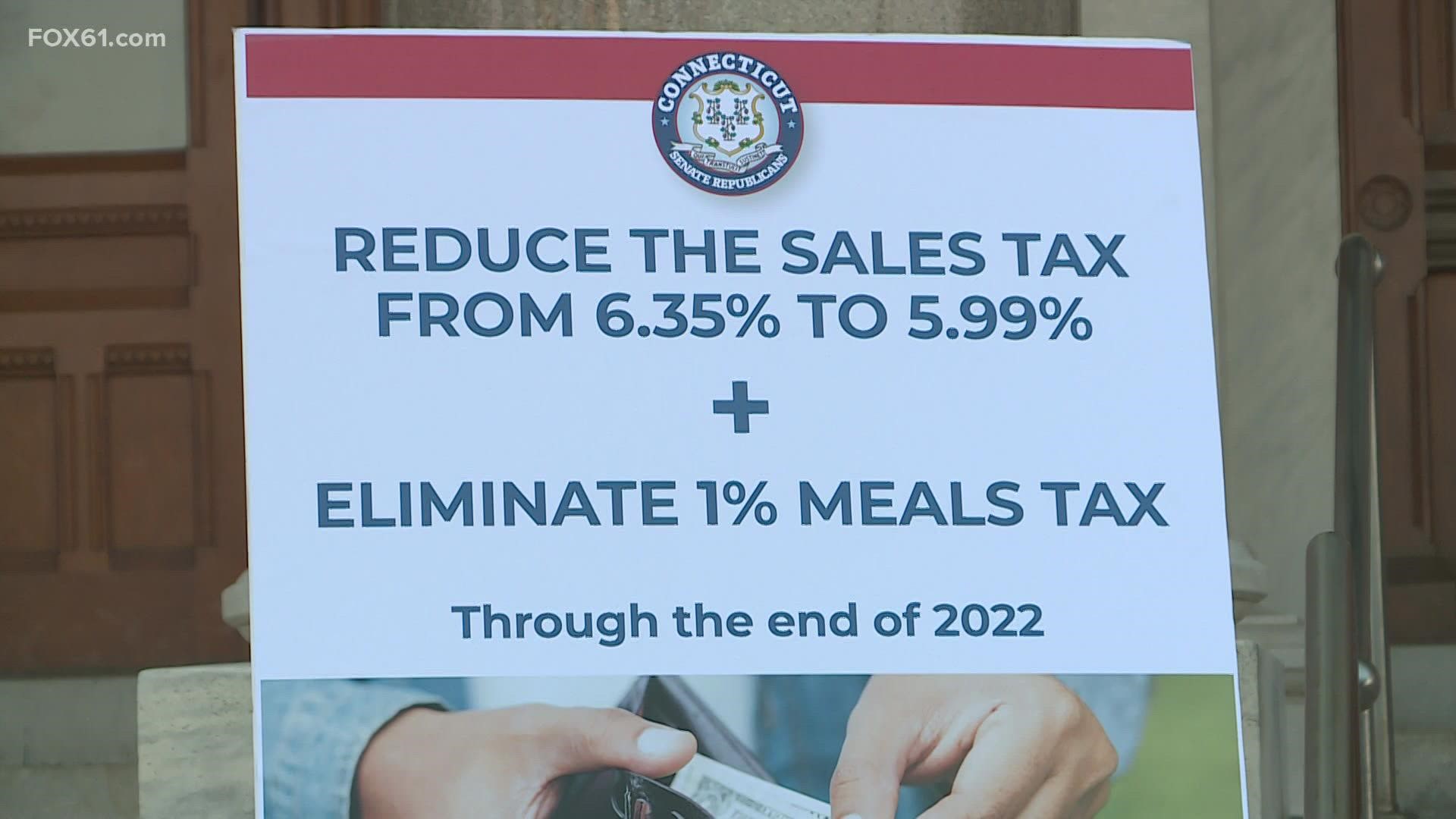

Ct State Gop Proposes Sales Tax Reduction To 5 99 Fox61 Com

Connecticut Manufacturers Credits And Sales Tax Breaks For Utilities

Connecticut S 2020 Sales Tax Free Week August 16 22

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

Connecticut Legislative Update The Cpa Journal

States Sales Taxes On Software Tax Software Software Sales Marketing Software

Exemptions From The Connecticut Sales Tax

Report Ct Never Came Up With A Plan To Collect More Online Sales Tax Connecticut Public

Connecticut Manufacturing Sales Tax Exemption For Machinery

Sales Taxes Association For New Canadians Nl

State Corporate Income Tax Rates And Brackets Tax Foundation

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

State Corporate Income Tax Rates And Brackets Tax Foundation

Ct Sales Use Tax Resale Cerfiticate Fill Out Tax Template Online Us Legal Forms